Notice

Recent Posts

Recent Comments

Link

| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 |

Tags

- tableau

- 아셈듀오

- 제네바경영대학교

- 태블로

- 교환학생주거

- 아셈듀오 선정

- 테이블계산

- 키워드시각화

- 제네바주거

- 제네바

- 패스트캠퍼스 #자료구조 #코딩테스트 #배열

- 태블로 포트폴리오

- 공모전후기

- 데이터 포트폴리오

- 미래에셋 공모전

- CRM

- 두잇알고리즘코딩테스트

- 교환학생

- 리뷰분석

- 텍스트분석 시각화

- 무신사 데이터분석

- MairaDB

- 교환학생 장학금

- 제네바기숙사

- 데이터공모전

- 파이썬

- 데이터 시각화 포트폴리오

- HEG

- 데이터 분석 포트폴리오

- 아셈듀오 후기

Archives

- Today

- Total

민듀키티

Microeconomic - Government Policies 본문

1. Price controls

(1) Price Ceiling vs Price Floor

- Price Ceiling (가격상한) : maximum on the price

- The price ceiling is binding if set below the equilibrium price -> leading shortage.

- Price Floor (가격하한) : minimum on the price

(2) Price Ceiling

- (a) A Price Celling That is not binding -> above the equilibrium price

- (b) A Price Celling That is binding -> below the equilibrium price -> leading shortage

- becase Demand quantitiy > Supply quantity

- nonprice rationing -> Long lines, discrimination by sellers

Example - The Price Ceiling on Gasoline

- the price celling is not binding and above the equilibrium price

- supply falls

- price celling becomes binding

- resulting in a shortage

- Case Study - Rent Control (임대료 통제)

- Gole of the rent control policy : to help the poor by making housing more affordable

- Short run : Supply and Demand both very inelastic ( 단기적으로, 임대주택의 수는 고정되어 있음. 즉 공급은 고정되어 있다. 집을 구하는 사람의 수는 변하지 않을 가능성이 높음. 즉, 단기적으로는 inelastic)

- Long run : Supply and Demand more elastic ( 장기적으로, 수요자와 공급자들이 민감하게 반응함. 공급자들은 (임대주택 주인들) 새로 짓지 않음. 수요자들은 임대주택을 구함. 즉, 장기적으로는 elastic

- Reasons of goverment intervene (이거 쫌 이해안감,, )

- No Perfect market competition : few landlords / many consumer

- heterogenous servie ,, ?? ,,

- Search and moving cost are high

- Imperfect competition : suboptimal allocation of resources, So goverment intervation could be efficeienct enhancing

- Equity issue

- Rich household more margin to adapt to changes in rents than poor household.

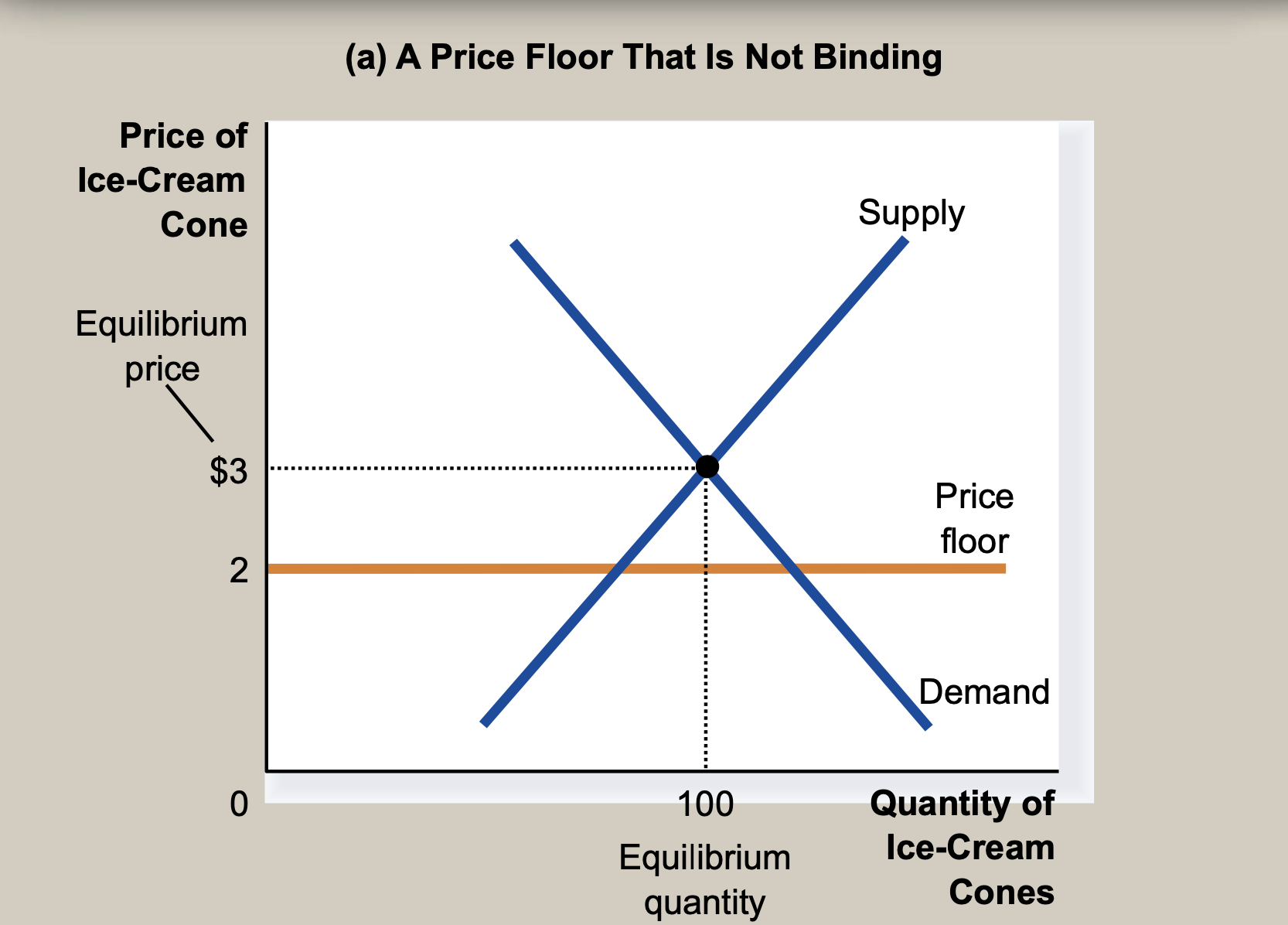

(3) Price Floor

- (a) A Price Floor That is not binding -> below the equilibrium price

- (b) A Price Floor That is binding -> above the equilibrium price -> leading surplus

- becase Supply > Demand

- nonprice rationing -> The minimum wages ( important example of price floor ), agricultural price support

- Case Study - Minimum Wage

- Minimum Wage : Supply > Demand (즉, 공급량이 많다는 것은 실업이 발생하는 것을 의미)

- Minimum wages around the world

(4) Taxes

- Goal : to raise revenue for public projects

- Taxese discourage market activity

- Quantity sold is smaller

- Buyers and sellers share the tax burden

- Taxes result in a change in market equilibrium.

- Buyers pay more and seller receive less, regardless of whom the tax is levied on

- Case 1 : A Tax on buyers (소비자한테 부과하는 경우, 수요가 감소할 것임)

- A tax on buyers shifts the demand curve downward by the size of the tax ($0.5)

- Result : decrease quantity of ice - cream cones

- Price without tax : 3.00

- Price buyers pay : 3.30

- Price sellers recieve : 2.80

- Tax of buyers ( $0.3 ) > Tax of sellers ( $0.2 )

- Case 2 : A Tax on Seller ( 공급자에게 부과하는 경우, 비용이 증가할 것임)

- A tax on sellers shifts the supply curve upward by the amount of the tax

- Result : decrease quantity of ice - cream cones

- Price without tax : 3.00

- Price buyers pay : 3.30

- Price sellers recieve : 2.80

- Tax of buyers ( $0.3 ) > Tax of sellers ( $0.2 )

- Case 3 : A payroll Tax

(5) Elasticity and Tax Incidence

- How do the effects of taxes on sellers compare to those levied on buyers?

- (a) Elastic Supply, Inelastic Demand

- Scope : Supply < Demand

- Consumer tax > Producers Tax

- (b) Supply inelastic, elastic Demand

- Scope : Supply > Demand

- Conumer tax < Producers Tax

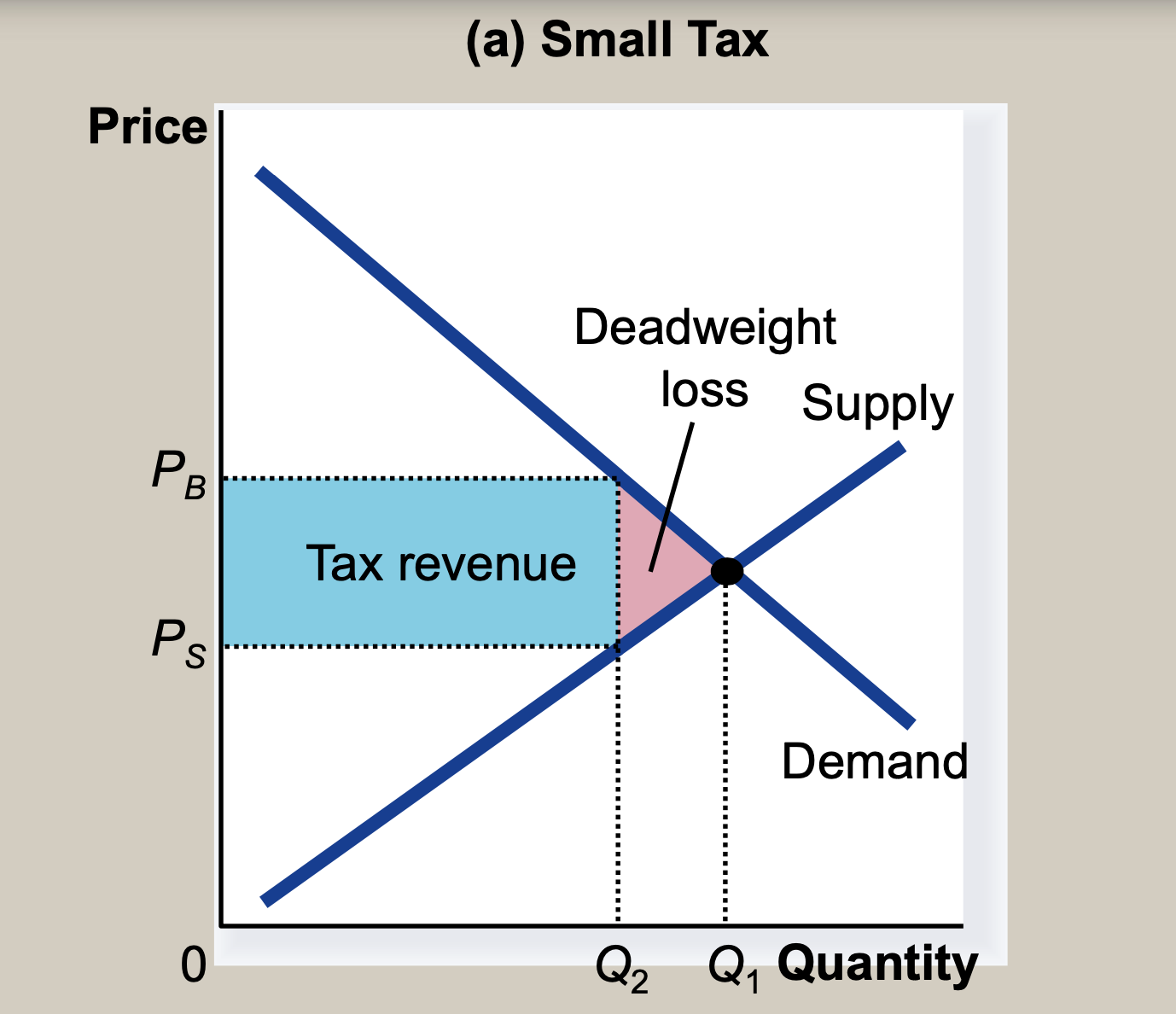

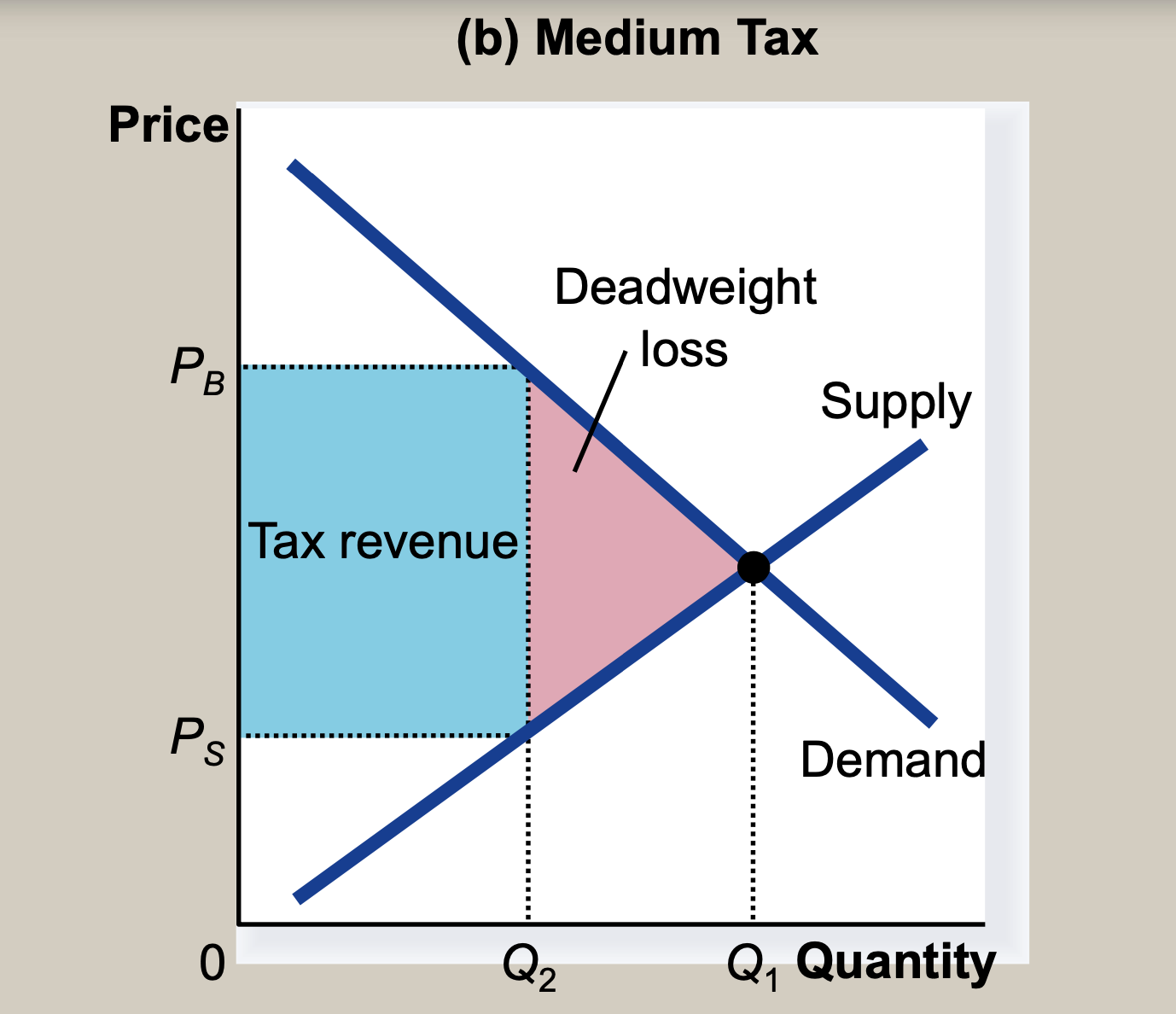

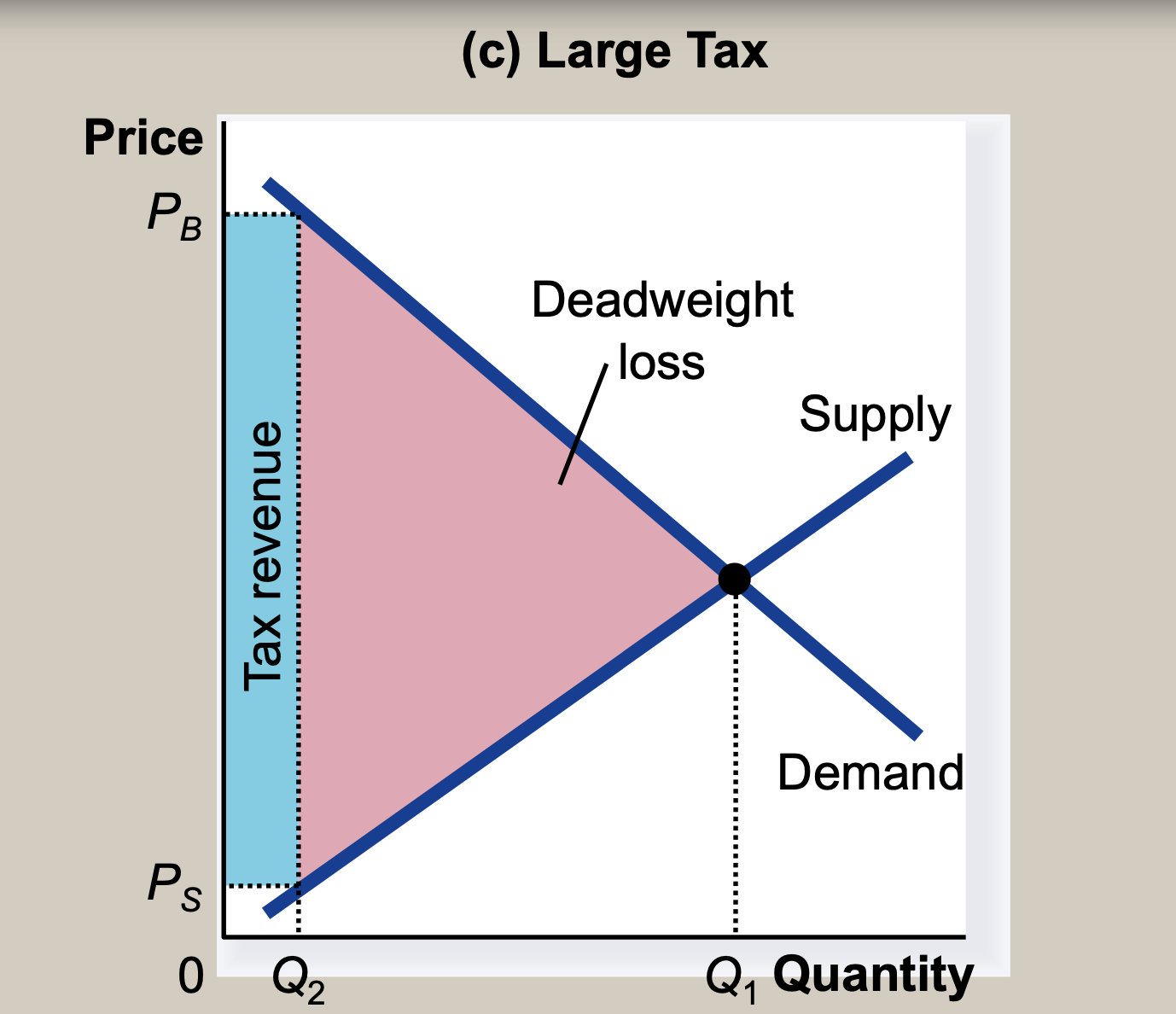

(6) The Costs of Taxation

- How do taxes affect the economic well-being of market participants? - Key Concept: The Deadweight loss of taxation

- (the goverment's) Tax Revenue : the size of the tax (T) * the quantity of good sold (Q)

- A deadweight loss is the fall in total surplus that results from a market distortion, such as a tax.

- Deadweight : C+E

(7) How a Tax Affects Market Participants

- The change in conusmer surplus

- The change in producer surplus

- The change in tax revenue

- The losses to buyers and sellers exceed the revenue raised by the goverment.

- The fall in total surplus is called the deadweight loss

(8) Determinations of the deadweight loss

- The greater the elasticities of demand and supply :

- the larger will be the decline in equilibrium quantity and

- the greater the deadweight loss of a tax

- (a) Inelastic Supply : the deadweight loss of a tax is small

- (b) elastic Supply : the deadweight loss of a tax is large

- (c) Inelastic Supply : the deadwieght loss of a tax is small

- (d) elastic Supply : the deadweight loss of a tax is large

(9) Deadweight loss and tax revenue as taxes vary

- After a specific interval, the tax revenue decreases

- As the size of a tax increases, its deadweight loss quickly gets larger.

- But,tax revenue first rises with the size of a tax, but then, as the tax gets larger, the market shrinks so much that tax revenue starts to fall

- So, Revnnue curve is same to Laffer curve (relationship between tax rates and tax revenue)

'International Businessment' 카테고리의 다른 글

| Microeconomics - Monopolies 1 (0) | 2023.12.20 |

|---|---|

| Microeconomic - Externalities (0) | 2023.12.19 |

| Microeconomics - Public Goods (0) | 2023.12.18 |

| Microeconomics - Elasticity and its Applications (0) | 2023.10.15 |

| Microeconomics - Supply and Demand (0) | 2023.10.15 |